Buying Websites For Sale: What You Need To Know How I Make $3K/Mo

When you buy something through one of the links on our site, we may earn an affiliate commission.

Hey guys. I’ve had a lot of people reach out to me that are interested in buying websites or selling websites. It seems as though more people are starting to realize how possible it is to purchase a pre-existing established business that's for sale and already has cash flow and customers rather than spend years building one from scratch.

I’ve bought several established websites for sale myself. And I love sharing what I know.

But this time I wanted to invite some guests to share from their own experience on online business.

Buying Websites for Sale With Hayden Miyamoto

First off is an interview with Hayden Miyamoto. Hayden has started a couple of different firms that collectively have bought over 20 businesses in the last three years.

So I’ve invited him to share his thoughts.

He also just started a new company called Kingmakers that is an accelerator that helps. And gives people the opportunity to buy their first established internet business.

He just launched the business and is offering free consultation calls where he and his team will answer questions related to purchasing businesses that business owners are looking to get sold.

If you are thinking about acquiring a business, I would highly recommend you get in touch with him and his team!

With that said, please enjoy this interview:

Spencer: Hayden, welcome back! If you would, please give us a little more background on yourself and your story.

Hayden: Thanks for having me again Spencer! Yeah, so I started out in online entrepreneurship when I was 17 years old. After dropping out of high school.

I’ve never actually had a real job, so to speak. And I’ve founded pretty much every type of online business you can think of.

My MO recently has been to bring down small groups of aspiring entrepreneurs to this small town in Mexico I live in, train them on how to operate online businesses, and give them the opportunity to keep them on as managing directors of those businesses.

Originally that was with businesses I had founded.

Then over the last several years, it’s been with businesses we’ve acquired. Where I really cut my teeth was co-founding Wired Investors.

We purchased just shy of 20 established income producing websites in the space of a couple of years, most of which we still own and operate today.

Deven, Neil Patel and I also founded Media Block this last summer and are purchasing some larger deals there.

Spencer: That’s incredible. Now with acquiring that many businesses, you had to have made plenty of mistakes.

What do you think were some of the most valuable mistakes you made and learned from?

Hayden: There’s a phrase I like to use: “Move fast and break things.” Essentially the idea is to completely immerse yourself in something, take massive action, and pack a lot of mistakes and therefore valuable learning experiences into a short period of time.

This is basically what we did with Wired Investors.

We wanted to get a large gamut of experience in the space and then learn from those mistakes and figure out what our strengths were.

So we bought all sorts of businesses. We bought a lot of media publisher businesses, we bought SaaS businesses, we bought productized services, we bought service-based businesses…you name it. We did it.

And that was the first real learning experience. Figuring out exactly where our sweet spot was.

The other major thing we learned is how important deal sourcing and due diligence is.

Just how important it is to get right and create this bulletproof process for finding and analyzing a business you want to buy.

It took quite a bit of time, but I would say deal flow and diligence is our greatest strength now.

We’ve developed a lot of proprietary systems and even software that gives us a significant edge over the competition.

And allows us to efficiently help other people buy businesses at great valuations.

Spencer: For sure. I mean if you want to buy websites for sale, finding the ideal match and then being able to ask the right questions and gather the right information on it before you drop a lot of cash is obviously incredibly important.

Can you go a little more into depth on that?

Hayden: For sure. I mean at the end of the day like you said, it’s just asking a lot of questions. What takes time (weeks, months or years) and experience is knowing what the right questions are.

But taking a step back to deal flow and sourcing, what we really excelled at was creating systems that significantly cut down the time it took to find great deals.

At the end of the day, it’s a numbers game. We probably initiated 50,000 conversations in order to buy those 20 businesses.

As you can imagine, that could have potentially taken years.

Instead, we created and used a repertoire of robust systems and tools to automate the process of reaching thousands of businesses, follow up with them, get on calls, and essentially find an interested seller and a great business that fits our target mandate.

Then, once you find a business you like and seller that’s willing to sell for the right price, your next goal is to do your diligence and get an LOI in place. Due diligence is where you really start asking detailed questions.

We have designed our due diligence to ask questions about how the business operates, questions about its traffic, questions about how it’s monetized and much more. This is what has helped us to become successful at what we do.

But you’re not done after that, either.

Next, you want to look for and identify all the possible risks that would come from possibly owning that business.

And even more importantly, create a plan to mitigate those risks.

Then you are going to want to focus on all the opportunities that exist and create a very detailed growth plan. You do this so that after you buy the business, you have a clear roadmap towards the appreciation of your new asset.

That may seem daunting at first, but that’s why we exist.

We have designed the entire process down to a science (list of to do's and don'ts), and now we’re helping other first time business buyers succeed at scale.

If anyone is reading or listening to this and you’re intrigued, we would love to chat with you. We’re always happy jumping on the phone to answer any questions people have on the process.

Spencer: For those that are interested in learning more, Hayden’s team at Kingmakers is offering free 1 on 1 calls. They can provide further details on this page.

So taking a step back, in your own words, why would someone want to do this? What do you love about acquiring and running online businesses?

Hayden: Well it’s a pretty personal reason for me but also kind of practical. You know, when you’re looking at online companies for sale, often it's one that can be run from anywhere.

I mean, let’s say you choose to buy an offline business instead. Let’s say a laundromat (or even real estate).

Maybe the best laundromat for sale is in Omaha Nebraska. It’s low risk, has great cash flow, and the seller is willing to let it go for a very reasonable price. That’s all great but, well, you may not want to move to Nebraska.

Whereas with the vast majority of online companies, you can run them from everywhere and there's typically a host of experienced staff, operators, providers and agencies you can hire globally to help manage the business. It’s also easier to scale.

Take the previous example of the laundromat and let's say you want to create a laundromat empire.

You go and buy that one in Omaha and then ideally you would want to find another several in the same city to truly get the benefits of scale. But this might not be possible.

Instead, you could end up owning separate laundromats in different states hundreds of miles apart. It’s possible to create a business like this, but it's hard.

What’s far easier is buying growing online companies and being able to relocate them anywhere and work on them from anywhere.

With online companies/online real estate, you can also scale globally and tap into other markets with more ease. It’s easier, it’s faster, and it just scales better overall.

Another reason I love this type of asset is that it’s very easy to passively own them as opposed to an offline business.

If we would have bought 20 local offline businesses, we would be far more involved in the day-to-day operations than we are now.

Whereas with these growing online companies it’s very easy to be a passive owner and let the business work for you and gain passive income.

There are many other reasons, but those two stick out to me the most; your ability to scale and then become more of a passive participant in the business.

Spencer: A lot of people think there are major barriers to buying an online company (somewhat similar to real estate) and so they never take action out of fear. Can you dispel these?

Hayden: Yeah I think a lot of people get stalled in this process for a few reasons. One being that I think they go to these sites and platforms where these deals are listed and they don’t find anything they are interested in.

That or they might feel it’s overwhelming and just give up. It’s important to understand that there is just a giant, giant world of businesses out there beyond the ones you see on your typical broker sites.

All it takes is the right method and some good old fashioned elbow grease to go out there and find those diamonds in the rough.

The key to not being overwhelmed is to get really clear on your investment thesis.

That is, the exact type of business you want to buy, how you want to buy it, etc. This way you can quickly filter through and say no to anything that doesn’t meet your target mandate.

Your mandate would include things like, what niches you’re interested in (which should align with unfair advantages you have), what type of business you want to buy (a publisher vs software as a service for example), and what your target multiple, deal-size and offer structure is.

Which will often depend on your financing.

Spencer: That’s a great point. I think another barrier people perceive is how to go about financing the purchase of a business.

Can you elaborate on that?

Hayden: Let me assure you, it’s easier than you think. There are so many ways to close a deal that you are basically limited by your own creativity, which can seem daunting if you’re just starting out in the space.

First things first, a large part of what attracts people to this space are the low valuations they go for.

We buy businesses for 3x their annual profit. Meaning if a business is making $100,000/year, we buy it for $300,000.

Assuming the business doesn’t grow and doesn’t decline, this delivers a 33% per year return.

However, because the space is still in its nascency, structuring a deal with 25-30% “seller financing” – which is the equivalent of a vendor-take-back mortgage – is quite common. This financing is generally at an 8% interest rate, so you’re looking at 25%/yr profit there.

Next, there are tons of banks that are willing to make loans with the same types of interest rates.

Basically as long as you have a decent credit score and some cash for a down payment, there are a variety of different ways we can connect you to financing and help you close.

Our specialization is in helping buyers purchase a business that is earning anywhere between $300,000 and $1mm in profit per year. Let’s say you wanted a business making $300,000/year, with a purchase price of 1mm.

With the right structure and financing, you can put down $100,000 for that business/company, and make 80k per year AFTER debt repayment (assuming the business just stays flat, doesn’t grow and doesn’t shrink).

That’s an 80% ROI, and you could turn around and flip that business after 3 years with over $250,000 in profit. Or you could hold onto it for the cash flow.

If you only have $20k to put down, just divide those numbers by 5.

You don’t have to be a millionaire to do this! You can be buying and selling websites in no time.

Spencer: So, what type of person is the best fit to purchase established ready made websites for sale?

Hayden: That’s a great question. We’ve really seen two types of individuals (entrepreneur) that are interested and that seems to be great candidates. The first type is people who are more entrepreneurial in nature.

Meaning individuals that have previously started businesses from scratch.

They know how hard it is to bootstrap it from the ground up. You spend the first couple of years without much of a paycheck and you spend a bunch of time developing your product, building your customer base, and building a successful organization.

So we see a lot of buyers (entrepreneurs) who have done this and succeeded.

Or had a harder time of it, and instead of doing that again, they are ready to short cut that process and buy an existing business…something that already has some legs.

The other type of person we see are individuals who have had more of a traditional career path.

They’ve worked in, say, the corporate world for many years, built up some savings, and now aren’t as excited about the path they are on and are looking for a change.

Now they are looking to be a little more independent, but they don’t want to go from having a stable job to earning much less by starting a business from scratch, and so the idea of buying a business with existing customers and cash flow is really appealing.

It’s exciting for us to talk to these kinds of individuals and reveal just how possible this is, and that the barriers to entry are much lower than they may think.

Spencer: What are the types of things that someone can do to websites for sale that make money that hasn’t already been done by the founder to accelerate its growth?

Hayden: One thing that we’ve seen is lacking across the vast majority deals is conversion rate optimization. Nobody does it, but everybody should. It doesn’t matter what the business is.

Just doing things like A/B split tests, price testing, initial usability tests to make sure the site is optimally designed and other related things makes a huge difference.

We can generally count on getting an automatic 30-50% lift on any businesses that we buy by doing things like this.

And out of all the businesses we’ve looked at, I’ve literally never seen one that has actually said for example “Yes, I’ve done price testing on some kind of SaaS offering” or “Yes, I A/B test my highest traffic pages every month.”

It blows my mind that more buyers don’t do these things, but it’s an nice win for us.

Even simpler, if for instance, the business is monetizing via affiliate links and commissions, nine times out of ten we can negotiate a better rate, and nine times out of ten the seller has never tried to do this.

It’s the simplest win ever.

Spencer: Love it man! And I really appreciate you sharing your knowledge.

Before I let you go, let us know one more time how an entrepreneur can get involved in what you are doing.

Hayden: For sure! So you can find us at kingmakers.co. Please feel free to get in touch with us, especially if you are seriously interested in buying a business. We’ll ask you some questions and let you know how we can help.

We’re only accepting a small number of applications so it will be an intimate in-depth experience.

We’re essentially going to pull back the curtains on our private equity firm that acquires and operates six plus new businesses per year. Any entrepreneur can be part of this huge event.

At the end of the conference, we will be partnering with a select group of attendees to source, diligence, and acquire their own potential deals.

We will also help with operating the business. It’s going to be a great time and I hope to see you there!

Buying Like a Boss on Flippa with Stacy Caprio

Next, we have a great post from Stacy Caprio who is the founder of Her.CEO.

Stacy is going to break down four lessons that she has learned in her business buying experience.

She has made all the mistakes of buying businesses for sale so you don’t have to!

Here's Stacy:

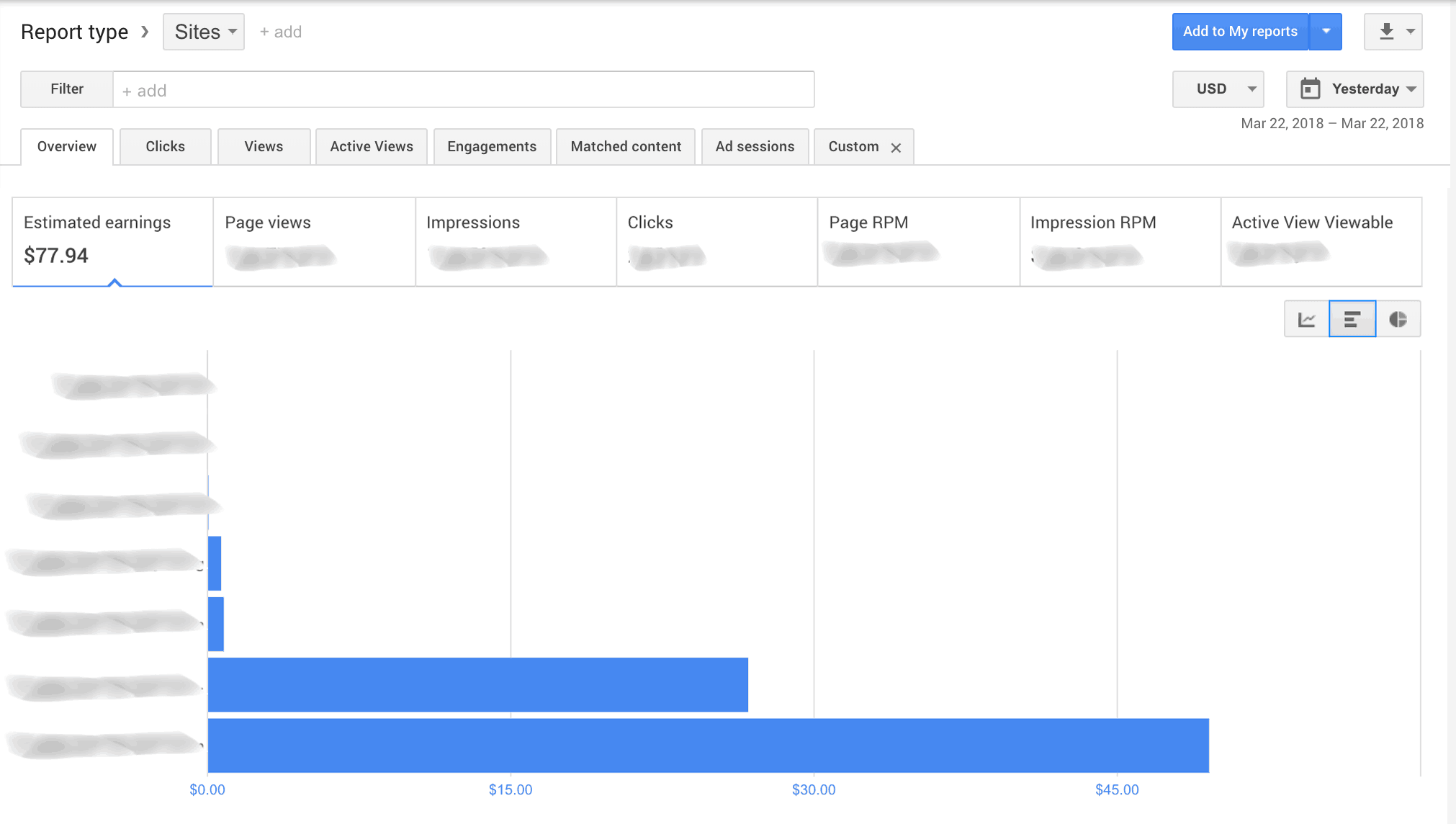

Opening your computer screen and seeing revenue numbers like this doesn’t happen by accident.

Read this article to learn:

- How you can avoid my mistakes

- How to purchase websites for sale which will be profitable

- Returning your investment in one to two years

- And then offering purely profitable positive cash flow into your bank account

The key is how you're operating the business and is based on quality.

Part of the reason I’m writing this article is to give back to the Niche Pursuits community.

As I would not be in the position I am today or an established successful website owner if it were not for some of the articles I’ve read on the website about passive income and owning an internet business for sale.

I’ve been a Niche Pursuits email subscriber for a few years, and I’ve found the information in their emails to be incredibly valuable.

When I see a Niche Pursuit email address in my inbox I either read it right away or star it so I can read it in the near future.

I first heard about the idea of buying successful authority websites for sale and selling websites in a Niche Pursuits email article. And a few months later that article is the reason I decided to purchase my first Flippa website.

I’ve made a lot of mistakes buying websites for cash flow. Which I want to share with you here so you can avoid making similar, quite expensive, errors like I did.

I have also learned a lot from these mistakes and have a few successful site purchases that I will continue to grow and build on.

I plan to invest my successful site proceeds into more website purchases as they continue to bring in revenue(making that cash flow work for me).

What I've Learned From Investing in 4 Established Websites Bought on Flippa Overview

Site #1 lesson – Don't believe everything they tell you. Always verify revenue claims.

Site #2 lesson – Look at the long term, don't invest in something that is a fad or trend.

Site #3 success – It's possible to make all your money back + pure profit in 10 months. If you learn from past mistakes.

Site #4 success – Always buy sites under 20X monthly valuation, when you pay attention to detail you may be able to get them for only 10X.

How To Get Started Purchasing Your Own Site

Site #1 Lesson: How To Buy Existing Established Websites for Sale with Traffic Without Getting Scammed

While there is plenty of potential in buying an existing website from the current website owner and ramping it up into a more in-depth business model that you control, you need to do your due diligence, as well.

This goes whether you're looking at an active listing or doing a cold outreach.

Don't Believe Everything They Tell You, Always Verify Revenue Claims

My first visit to the website broker Flippa, I was very curious, open and completely naïve. I saw all these revenue numbers for sites and my mind was blown that these internet businesses could all be making that much money!

While searching, I found a site that claimed to be making $350/month from Amazon affiliate revenue. I asked what they would be willing to sell for. We negotiated $1,300 for the site, less than a 4X monthly valuation.

I was so excited to purchase my first site. And I thought it was such a good deal that I completely trusted the seller.

I did not second guess, look into, or even use my common sense to check the revenue numbers.

The business owner posted a few sales screenshots and sent me some revenue number screenshots. But looking back, they were likely revenue screenshots of his entire account lumped together, not just the site he was selling me.

Turns out the site was only making $20-50/month on a good month. It really hurt to be tricked like that.

But it was an incredibly valuable lesson to learn, as I never made the mistake of overvaluing a site again.

Lessons Learned – What You Need to Know

Looking back, being able to purchase a site for under 4X monthly valuation is in itself a huge warning sign. If you see someone selling established websites for anything less than a 5 or 7X monthly valuation, it stands out to me in big red as a scam or lie.

Most business owners have worked hard to build a sitebefore looking for qualified buyers. If it is valuable and making them passive income every month, they will work to explicitly verify their revenue and get a decent 15X+ monthly valuation price or more.

One great feature on the Flippa site is “verified revenue” numbers for all sites that make revenue via Adsense.

Flippa also verifies page views and visitors via Google Analytics. When I look at sites now, I only consider sites with both verified Adsense revenue and Google Analytics.

This site also did not have verified revenue numbers, as it made money as an Amazon Affiliate site. It did have verified Google Analytics numbers, however.

I could have easily used my common sense and looked at the Google Analytics data to realize the site seller was lying about the $350/monthly revenue. The Google Analytics traffic averaged 1,000 visits a month.

So even at an astronomical 5% conversion rate, that would be 50 conversions a month, making around $1 or less/conversion.

I would have easily been able to tell the site was making well under $50/month if I had applied some common sense and basic math skills before pressing the buy button.

There is no reason not to buy an Amazon FBA or affiliate site as long as you thoroughly look into the numbers and use common sense to double check the numbers using Google Analytics data and industry average conversion rates. Don't just take the word of the seller.

Both of which I did not do.

The main takeaway from my lesson learned on this site is don’t be too eager. Buyers should look at the site objectively and carefully before making an offer.

Site #2 Lesson: Buy The Perfect Profitable Starter Websites for Sale That Will Last Forever

Even factually true numbers can lie. Search engine numbers are great. But make sure you're buying an established website that is evergreen.

You don't want to become the business owner of a dying fad.

That's an easy way to learn a painful lesson about losing money buying websites.

Look at the Long Term, Don't Invest in Something That is a Fad or Trend

My second site purchase was also made in a poor state of mind. I was in desperation to find anything I could buy that would make me over $1,000/month so I could quit my job.

Being in a positive, neutral state of mind while looking at new listings of small businesses for sale and purchasing a site is something that will help you avoid making huge mistakes.

This time, with my newfound appreciation for double-checking and verifying site revenue, I found a site making $500 “verified Adsense” monthly revenue.

Looking at the Google Analytics and doing a basic RPM calculation, I realized the site could easily make double or triple that – so there was a pretty decent annual profit to be had.

Switching to a more profitable display advertising provider alone would be enough, provided the traffic stayed stable.

I made an offer to the seller and purchased the site at a 20X monthly revenue valuation.

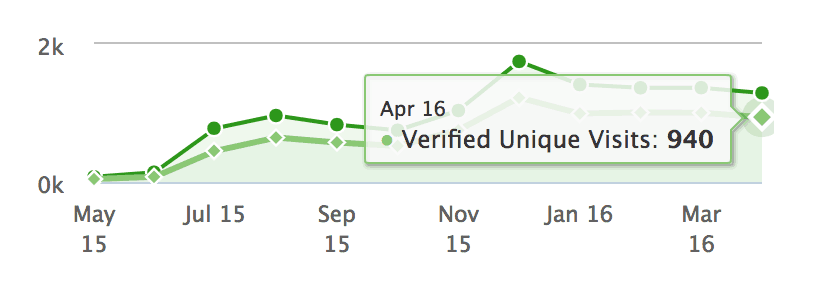

At first, the traffic stayed stable and I was able to double the monthly revenue to over $1,000/month by switching display advertising providers. so far so good with my new business.

Lessons Learned – What You Need to Know

Turns out my assumption that “traffic would stay stable” was completely false in this case.

In a better state of mind, one other than pure desperation to have a profitable asset, I probably could have seen this coming, but as it was, I was desperate.

The site was an iPhone game app answer site. Game applications have a half-life of 6 months, and in a few months in traffic started to sharply decline.

As of today, 1 year later, I’ve made back 75% of the website cost and it continues to return minimal revenue. Despite the small passive income, however, I still look at is a failed investment.

Mistake made, and lesson learned.

Your takeaway from this is to only invest in long-term ideas and sites, not ones that are passing trends, games or fads.

Don’t make my mistake again, and I know I never will!

Site #3 Lesson: Finding the Best Businesses for Sale that Make Money

There isn't a single business model that promises a profitable website. There are many different ways to make money online.

The key is finding the right online businesses for sale that you can improve and profit from.

At the right price, of course.

Make All Your Money Back + Pure Profit in 10 Months If You Learn from Past Mistakes

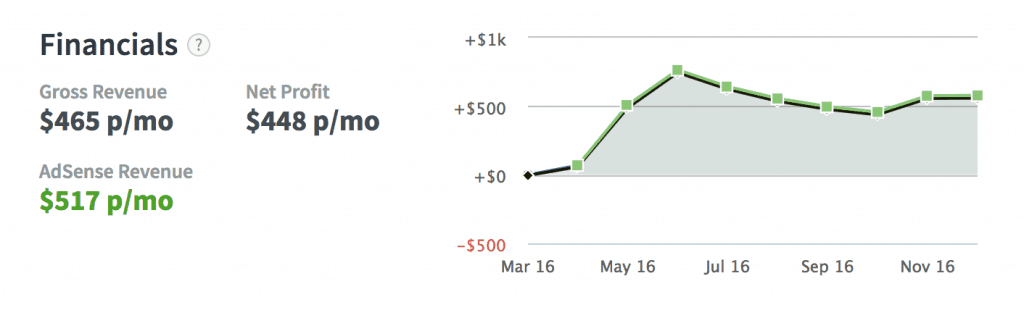

My third internet business was a two-site combo, which I of course carefully verified the revenue on, and picked a stable niche.

A bonus to my third site is that it has a committed community that continually generates content for the site, making it completely hands-off for me.

I bought this site at a fair 20X monthly valuation and knew I would be able to at least double the ad revenue. Making my money back much sooner than 20 months.

I was able to increase the monthly ad revenue from $370 to $1,200/month by partnering with several different ad providers.

It’s been 10 months since I purchased the site and I’ve made back my entire initial investment + an additional $1,600 in pure profit. I continue to make $1,200/month in pure profit from the site.

Lessons Learned – What You Need to Know

A key, and often overlooked, component of buying websites for sale (this also includes an Amazon FBA business) is being in a good state of mind.

When you are not desperate and are able to be objective, you’ll be able to evaluate a site’s revenue accurately, pick a stable niche, and make an offer that is fair for you and the seller.

That creates a win-win situation for everyone involved.

Site #4 Lesson: How To Buy Profitable Established Websites Cheap

Buying a successful existing website is often far easier than building a profitable website from scratch. If you know what you're looking for you can scale up to create a much bigger income stream.

That's a winning situation as a business owner right there.

Always Look to Buy Sites Under 20X Monthly Valuation

The truth is when you pay attention to detail you may be able to get them for only 10X.

The first site I purchased with a very small investment, which is what I recommend to anyone purchasing a site for the first time.

Buying a site from the website owner is always a risk, and starting small allows you to minimize the risk while still learning and possibly making a good deal.

My fourth site is the biggest investment I’ve ever made, aside from stocks.

I purchased it a month ago at an incredible deal. It was a 10X monthly valuation, which I was able to do with a special technique I’ll outline below.

The Expired Site Technique

I call this the “expired site” technique. I filter on Flippa to see sites that meet my minimum monthly revenue goal that are also no longer active auctions.

This means they have previously been put up for auction but no one bought them.

This means you have no competition when negotiating an offer and are speaking with someone who wanted to sell their site but was previously unable to. I’ve found the best deals are often found this way because they are often very profitable sites other individuals have overlooked.

This site has huge organic search potential. My goal is to double the organic traffic by next month. If successful, that meant I could see a full investment return in 5 months or less.

Even if traffic stays the same, a 10 month return is a very good deal and not something I would be disappointed with.

Remember, after the 10 months when your investment is returned, all revenue becomes pure profit.

Lessons Learned – What You Need to Know

To find good deals on sites (including an Amazon FBA business), focus on sites others have overlooked and search using the “expired site” method.

Also, focus on keeping your business offers at a 20X valuation or under to get the best deal. 20X valuation is the accepted standard on the Flippa marketplace.

(Update: The prices of sites have moved up and the current suggestion from Flippa is 2-2.5 years which would be 24X-36X valuation. But the concept here is still 100% effective and workable)

Have you learned a lot? And are now ready to make your own first purchase?

How To Get Started Purchasing Passive Income Producing Websites with Website Brokers

Website brokering is a multi billion dollar industry. There are plenty of options for finding deals on website brokers. But you need to know your options first.

(Note: Obviously for selling if you want the process made easy and make sure you get a fair price, we recommend selling on Motion Invest for an easy and smooth selling experience. Also a great way to have a thoroughly verified income claim for any site you buy.)

The Best Website Brokers Where You Can Buy and Sell Your Website

There are other good options. But these are the best website brokers as of publication.

Kingmakers

If you want to step right into owning a larger online business earning $250k to $1.5mm/year, then you should consider working with Kingmakers.

For owner financing on an established website, Kingmakers will help you find a great off-market established website for sale, perform extensive diligence, and finance up to 90% of the purchase price using an SBA loan.

They also invest their own capital into the business alongside you, effectively becoming your business partner.

Their team creates detailed growth plans for the business and provides additional training, resources, and staffing to ensure success. Schedule a free call with them today!

Flippa

If you're looking for small businesses for sale, Flippa is a great marketplace to check out. I bought all 4 of my established websites on Flippa.com because it is a site where if you look closely you’ll be able to find great businesses for sale. It's an immensely popular marketplace for profit generating online companies (your chance to own online real estate).

With over 800 thousand total users and $200 million in revenue, it is one of the top website sellers out there.

Not only does Flippa operate as website brokers, but they also buy and sell applications, website domains, and e-commerce online businesses like Shopify websites or Amazon FBA.

Flippa helps customers discover and get the most out of their business with the diverse products they offer.

There are many people selling established websites (an e-commerce online businesses as well) that don't know what they are doing too.

So be careful! Not all businesses for sale are a good investment! Think hard and analyze what the business offers – and not just in terms of annual profit!

Whilst you should always be on the lookout for new business opportunities, don't be enamored by the first e commerce business you see just because someone on Youtube is into dropshipping!

Empire Flippers

Empire Flippers are relatively new to the scene but have an impressive track record. In a short time period, it has been named one of the fastest-growing businesses in the United States.

Founded in 2013, since then they've sold over $93 million dollars worth of established websites.

Unlike EF, Flippa sites are often lower ticket sites and if you’re looking to spend upwards of $40K, you’ll likely have to look elsewhere. Empire Flippers is a great site with much higher ticket and value sites.

They pre-vet and verify sites beforehand so that you don’t have to be as careful vetting in advance because the sites are generally legitimate.

The only downside to Empire Flippers is you pay a premium monthly valuation, generally, 30X, as opposed to the 20X or under deals you can find when you look closely at Flippa.

Empire Flippers also takes care of the entire transaction for you, including transferring the site, which takes away the hassle of transferring established websites for those with no experience.

Latona's

If you are looking for a more personal experience when buying or selling your website or e-commerce websites like Amazon FBA then Latona's is the website broker you should be looking at.

When buying and selling websites with Latona's, you are assigned your own broker who will work with you until your website is bought/sold. The brokers are some of the best in their field.

They provide top-notch service and advice.

Although this website is generally known for selling smaller properties, the brokers at Latona's are happy to work with any price range.

Website Broker

Websitebroker.com is one of the earliest website brokers out there and came into fruition in the early years of the world wide web. Founded in 1997 by two attorneys, it has grown into one of the most trusted and well-established websites to buy, sell, or trade your websites.

They can also help with an e-commerce business like Amazon FBA or Shopify store that generates passive income.

Website Broker are known to have some of the most detailed website listings in the game. They also provide premium services that give more exposure to sellers listings, among other things. E-commerce stores have boomed in recent years, and Website Broker can help you get started with one of your own.

FE International

FE International is another fast-growing website broker. With about a decade of experience under its belt, FE International is known for its quick turnaround on sales. If you are looking to sell a website quickly this is the website broker for you as FE International boasts a 95% sales rate.

There is no doubt you won't have various business offers when selling your website with FE International.

If you're burned out from maintaining those e-commerce websites (Amazon FBA or Shopify store), FE International is sure to find someone to take it off your hands.

People are always looking into ways to generate passive income.

Also, over 85% of the websites listed sell within the first two months.

FE International is changing the industry with its success. While the company has changed over the years, its core values have stayed the same; to make the website buying and selling process safe and secure.

Quiet Light Brokerage

Quiet Light Brokerage is a leader in buying and selling high priced websites and domains. Websites bought and sold with this broker generally sell for six, seven, or sometimes even eight-figures.

Since 2006, they have sold over 600 businesses, making over $150 million in the process.

They have a team of experienced website buyers and sellers. This team helps entrepreneurs in their task of buying or selling their website.

They've helped many business owners find qualified buyers when they were thinking of selling websites. Or buying them.

Quiet Light Brokerage has been mentioned in some of the top financial magazines, such as Entrepreneur and Forbes.

Biz Broker24

BizBroker24.com is another website dedicated to selling high priced website businesses and domains. With 1200 plus sales and over 100 million made, BizBroker24 has been recognized as a leader in buying and selling websites and domains.

While they don't claim to sell your business quickly like other website brokers, they do boast a 95% closing rate, so expect your website to sell.

We Sell Your Site

WeSellYourSite.com is a website broker that is based on simplicity. The company actively promotes the easy buying and selling of websites as small businesses.

This is largely possible due to their free website evaluations and their simple sales and purchases structured listings.

They've been in business since 2004 and has since made over 100 million in sales.

Digital Acquisitions

Formerly known as Trusted Site Seller, this website broker has helped hundreds of customers buy and sell websites since starting in 2010.

Although Digital Acquisitions is known to have strict qualifications (they turn down over 80% of their potential customers), this ensures that only the highest quality of website buyers and sellers are available.

Not only is Digital Acquisitions known for their quality listings, but they are also known for their top-notch customer service.

Expect them to answer all of your questions and help you every step of the way.

Digital Exits

If you want to sell your website or e-commerce websites (Amazon FBA or Shopify store) for the maximum value, look no further than Digital Exits. Their website appraisers are some of the best in the business and will appraise your website for its worth and what it can actually sell for.

They also have a strict process, only listing the best websites that make yearly profits from as low as $100,000 or as high as $2 million, making it the perfect marketplace to sell internet businesses.

Website Closers

Website Closers is an Inc. 500 company that has made over $750 million in sales since starting over 20 years ago. They are known to have and retain some of the best brokerage professionals in the business.

Their detailed buying and selling process is unparalleled.

From in-depth consultations to custom sales strategies, Website Closers provides more than just a connection between a seller and an interested buyer.

The brokers at Website Closers go above and beyond to make sure you will have the best possible experience while buying or selling a website.

BuySellEmpire

BuySellEmpire is one of the most experienced website brokers. With a 95% closing rate and over $25 million made since its inception, they have become one of the leading marketplaces for buying and selling websites and e-commerce websites (Amazon FBA or Shopify store).

Founded in 2016, they have sold all types of business websites such as Amazon FBA, SaaS, e-commerce websites, and more.

Selling websites and buying them, is something they are really good at. If you're interested in buying or selling an ecommerce store, then BuySellEmpire might just be the marketplace for you.

Transferslot

Transferslot is a website broker dedicated to buying and selling smaller website businesses or side projects. The website is relatively new but has already made over $78,000 in total transactions, so they're becoming a strong brand in this arena.

With that being said, when it comes to buying/selling websites and e-commerce websites (Amazon FBA or Shopify store) their process is different than most.

To sell a website, you must first apply for consideration. The team takes over the process if you are selected.

They do all the promotion and exposure for you. For the first week, the website is exposed to a select few buyers (select entrepreneurs). If it isn't sold, the project will appear on their marketplace. On there, anyone in the general public can purchase it.

This website is perfect for those who want to sell small websites or those looking for DIY project websites to work on.

Other Ways To Find Profitable Established Websites To Purchase

There are other ways to find websites for sale and then proceeding to purchase great sites. Including simply using your email address and sending an email out to your email list if you have one. Or posting in website or social media (investment Facebook or Linkedin groups). Many buyers and sellers have connected in this way.

Think creatively. Think about the type of person who may already own your ideal website. Then think of ways to contact them.

There are many people who own profitable websites and internet businesses. Now it is your job to think of who and where they might be, and how you can get in touch with them.

The more creatively you think, the more opportunities you will have to find amazing sites.

I also offer a website buying service where I take care of finding a profitable site, negotiating and purchasing the site, transferring the site to your host, and offering advice on how to increase the traffic and profit.

Feel free to contact me if you are interested in learning more about how to hand the difficult parts off to me to buy a profitable website asset.

How To Negotiate A Great Price when Buying and Selling Websites

To negotiate a great website price, you’ll have to do the following:

- Get and verify all the stats

- Privately message the seller to get more information

- Build some trust and rapport

- Formulate the price you are willing to pay in your mind (which ideally should be 20X monthly valuation or under)

- Then ask the price they are looking for

If the price is under your maximum monthly valuation, then make an offer and you will have a new site. At a great price. Along with lots of potential to make the investment back plus much more as time goes on.

Just make sure to do your diligence on those selling websites, you never know what you might uncover.

Author: Stacy Caprio

Founder, Her.ceo

Is Buying Established Turnkey Websites a Good Investment?

So you've heard some success (and horror) stories. But let's take a moment to step back and ask the important question.

Is buying a website a good investment at all? Or are there better returns elsewhere?

Let's take a look at more common investments: stocks and bonds.

Since founding in 1926, the S&P 500 returns about 10% per year if you count the years when it only had 90 stocks in it. If you can get 10% out of your retirement portfolio, that's pretty stinking good.

Bonds tend to be less volatile, but their average return is between 5% and 6% per year.

And if you want to include real estate, the numbers vary a bit more. But most real estate investors can expect a return between 9.5% and 11.6% per year.

What do websites return per year?

The current metric right now is that websites sell for about 30x their average monthly earnings. So if your website makes $1000 per month, you can sell it for $30,000.

On the reverse side of this, you can buy a website for $30,000 and make $1000 per month. That is a 40% return per year.

And as Stacy said above, she often buys websites for a 20x or 10x multiple.

- A 20x multiple represents a 60% return on investment.

- A 10x multiple represents a 120% return on investment!

So buying websites can offer a lucrative return on investment for your money.

But what about the other precious resource? What's the investment on time?

Buying Websites and the ROI on your Time

There's more money in the world than we know what to do with. But what about time? After all, is something a great investment if you get a 120% return, but you only make $1000 a month while working 40 hours a week on your new project?

No! That's a horrible investment.

But not all websites are like that (in fact, almost none of them are).

Your can turn websites into passive income generating machines. That's the good news.

After websites have content and generate passive income, I would say that 90% of their activity is already passive unless you're producing more content.

Other non-passive activities could be managing an email list or posting to social media. But almost all of your website can either run on its own or be outsourced for cheap.

And it's not a super difficult process to do so.

If you want to buy a website and make it 100% passive, there are a few things to look for:

- Finding websites for sale that already have good systems in place

- Outsourcing/getting rid of everything someone else can do

- Remember the work is front-loaded

We'll to into more of each of these points.

Search Websites For Sale That Already Have Systems In Place

You might pay a bit more for a website that already has content, social media, or email systems in place. But the return on your time investment can skyrocket with this type of website.

You may not even have to do anything at all as a new owner.

Either way, be sure to ask any website seller how many hours they spend on the business each week. This gives you a rough idea of how passive the site could be.

Once the sale is made, ask the previous business owner any ideas he or she has about making the site more passive.

Just one good idea for your new business might help you achieve more passive income.

Eliminate Everything That Someone Else Can Do

In the multi-billion dollar industry of websites as a profitable online small business, there aren't many tasks that only you as the owner can do.

The easiest things to outsource are writing, editing, and uploading your content. These are the most expensive parts to outsource.

But it's very easy to find high-quality writers who are willing to post to your site for you with enough owner financing.

On my Niche Site Project 4, I'm using ContentPit to do just that.

About the only thing I'm doing for Niche Site Project 4 is just managing employees. I managed to outsource the whole thing. It cost me several thousand dollars. But this wouldn't be an issue for a website that's already generating cash flow.

Most people could make it 100% passive and still pocket a significant 20%-30% return on investment.

Remember That All The Work In Websites Happens In The Beginning

One thing I love about building niche sites as digital assets is that once you have the systems in place, everything is almost 100% passive. All the work on websites happens during the beginning.

After the initial charge, you can leave most of the work alone.

Often, you don't even have to outsource work. It's just done. Content is a great example of the type of work that takes one big initial push. And then after that, it brings you passive income forever.

Any article you publish, email subscriber you collect and lead you to capture is yours forever. This work is always working for you.

So remember with your site that most of the work happens in the beginning.

Niche sites are true residual passive income generating machines.

Buying Websites: Your Next Move?

Thanks for reading this post on buying websites for sale as an online business strategy! If it's been helpful, please let me know in the comments. I'm glad to do more things like this if I know that you guys and gals want it.

If this hasn't been helpful, please let me know what you'd like to see improved or what you have more questions about.

Buying a business in the form of already established sites requires a bit of a process and there's a definite learning curve.

I recommend that you start small and get your feet wet before investing everything you have.

And as long as you verify revenue and net profit, buy long-term successes, learn from past mistakes, and pay attention to detail, then there are some incredible opportunities with huge potential out there in the global online marketplace. The buying and selling of online businesses is now a multi-billion dollar industry.

Building up your portfolio of digital assets with website properties in this method means you can jumpstart your way to creating profitable online businesses (and check out our list of assets that generate cashflow for more ideas). It could even be the best investment of time and money that you've ever made.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations

8 Comments

Conversation

Fantastic Article to read. I really enjoyed this post. Thak you so much for sharing this. I really Like it.

Thak you so much for sharing this. Fantastic Article to read.

Hayden knows what he’s doing! Learned a lot! Thanks

Wow, very interesting topic you have there.. it’s always a good idea to learn from the experts, if only I have the cash to do all this kind of stuff then, I will definitely follow the steps just like what you did..

Thanks,

Nhick

Great to read! I also did quit my full time job to go fulltime online. I make between $2000 – $3000 monthly now for the last 6 months but hope to double that in 2019 as I am working on it fulltime now.

My plan is to buy new assets that already make money. My main site is exactly what you described. I spend 3 years aside my full time job building it from scratch, but gave me the freedom I have now.

But, it is really a lot of work while you can buy sites that make $300 – $500 for like $6-8k.

Unfortunately it is not easy to find them. You really need to search and I did buy 3 sites in 2018.

1 site making 1200 eur a year.

1 site making 700 eur a year.

1 site making 100 eur a year.

Not really the sites I am looking for. I am looking to buy a site that makes more than 300 eur a month now but it is really not easy to find.

Thanks for the tips again!

Flippa is no longer my goto place for buying websites. It is filled with dropship and e-commerce sites and very few websites there actually look legit and recently they disabled the comment feature.

Flippa is definitely going through some changes, and it will be very interesting to see what they morph into. Also if potentially some new player comes along picking up the slack / space Flippa left behind.

Hey Goran, I’m the content manager here at Niche Pursuits.

That will be interesting to see. Might be a good business opportunity for the savvy entrepreneur 😉