Real Estate Investing vs. Website Investing: Where Should You Put Your Money?

When you buy something through one of the links on our site, we may earn an affiliate commission.

When looking for investment strategies, you have lots of options.

You can buy stocks, mutual funds, gold, invest in a small business, and many others. A couple of options to consider are real estate (very widely known and practiced) and investing online businesses (i.e. websites).

Website investing is perhaps a little less known and practiced, but can potentially be a viable option for the right person. Both real estate and website investing can provide great returns and are very real investment approaches.

Real Estate investments can range in size from a couple of thousand dollars (a few shares in a REIT stock for example) up to many millions of dollars.

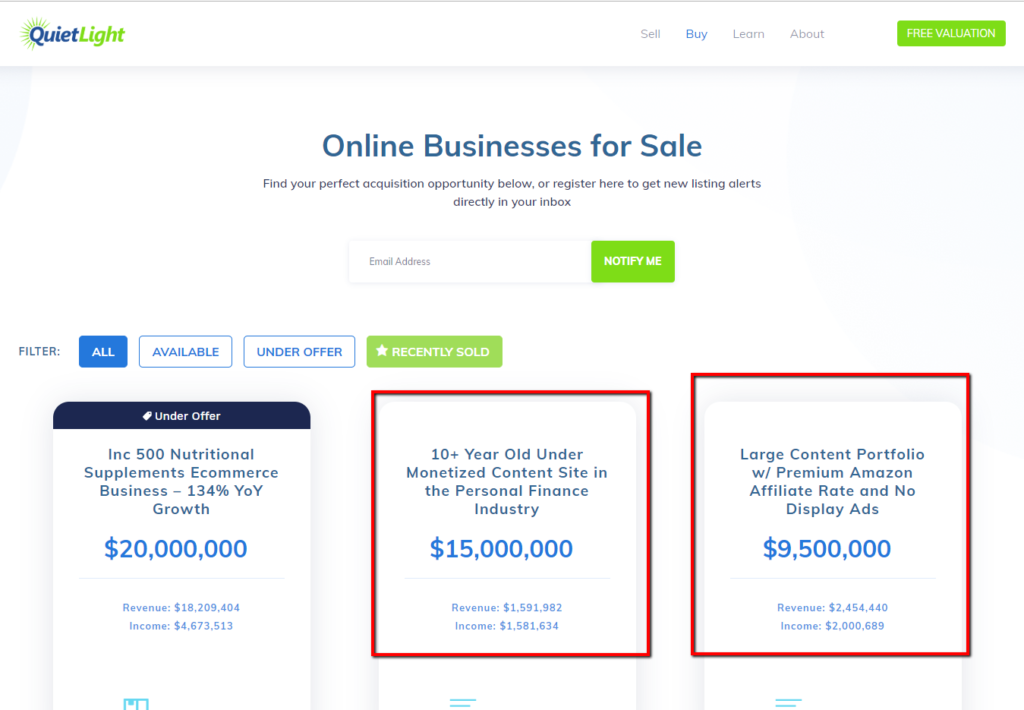

Believe it or not, website investments can have about as wide a range as well. You can buy a small content site on MotionInvest.com for a couple of thousand dollars or you can buy websites for over $10 or $15 million (like the ones recently listed on QuietLightBrokerage.com).

And technically Facebook is a website, so if you have billions, you can buy it as a publicly-traded stock.

Today, I want to dive into the pros and cons of each investment type and help you decide between real estate investing vs website investing.

Real Estate Investing

When it comes to real estate investing, there are lots of different ways that you can get a return on your money. Here's just a few:

- REITs

- Buy and rent residential properties

- Buy, fix, and flip residential properties

- Commercial real estate

- Apartment rentals

- Land development

- Mobile home parks

- Self-storage units

- Crowdfunding platforms for real estate

- and much more.

For our discussion, I'm going to focus primarily on residential investments that you hold and rent. This is the most common for individual investors.

Pro of Real Estate Investing

So, what's the expected return from buying and holding a rental property?

Your returns come from monthly rents and property value appreciation. So, depending on how much you charge for rent, occupancy rate, capital expenditures, and how long you hold the property will all going into the return on investment calculation.

Without getting into the weeds too much, an expected annualized return of somewhere in the 8 to 12% range is feasible.

When you compare this to the S&P 500 average returns, real estate can be slightly better as discussed here.

Leverage

Your cash on cash return is of course increased because of the fact that you can borrow money (i.e. leverage) for your real estate deals.

Leverage allows you to get a better return on your money over time and also allows you to invest in more deals. Using leverage from a bank is typically not an option for website investing.

Since websites don't have physical assets, the bank is usually unwilling to lend against the asset.

However, this does change if the online business is well-established (business tax returns for at least 3 years), profitable, and over a certain size (usually between $500k to $10 million). These deals may qualify for an SBA loan.

Stability

Real Estate is much more stable when compared to websites. Depending on the type of website, it can lose value relatively quickly. A Google update could cut the value of a website in half overnight.

Generally, real estate is less prone to these drastic drops in value. And over long periods of time, real estate has proven to be a fairly stable investment.

“Real” Assets

The big plus side of owning real estate is that there are truly hard assets. You have the land and the buildings and even though there can be large swings in value, there is additional stability because of the actual assets.

So, even if you have no renters and the property isn't making any money, it still has significant value.

A website doesn't have this extra security. If the website isn't making money or getting traffic, its value is almost zero (this can vary depending on the circumstance).

Cons of Real Estate Investing

Like any investment, there are risks. And this is certainly true of real estate.

Your property might get termites, burn to the ground, or have any other number of unforeseen situations that could negatively impact your investment. Rather than go through all the doomsday scenarios, let's compare real estate investing to website investing.

Lower Income

When compared to websites, your cash flow is going to be significantly lower with real estate. For example, a house that costs you $300,000 might only net you $10,000 for the year in cash flow. (This is a super rough example, so just go with it).

A $300,000 website on the other hand is going to be making roughly $10,000 PER MONTH! A website making $10,000 a month would sell for roughly 30 to 34x it's monthly income.

So, in terms of cash flow, you are likely going to make much less with real estate.

Active Ownership

Many people that get into the real estate rental business are often very hands-on. They are dealing with screening tenants, collecting payments, and doing repairs.

This can be a lot of work depending on the type and number of properties that you own. You can of course negate this by hiring a property management company, but this eats into profits.

Holding Period

Some of the biggest benefits of real estate come from value appreciation. However, it can often take decades to truly capture significant value appreciation. Overall, some of the biggest gains can be made if you are willing to hold your property for a long period of time.

Now of course this can be a short period of time if you buy low or time your holding period when there happens to be a wide swing in the marketplace.

Website investing

Website investing is the process of buying a website that is already making money and collecting that cash flow over a period of time (and don't miss our list of other assets that generate cash flow). Most website investors try to improve the earnings and increase the traffic to their sites, but others may just hold the websites as more “passive” investments.

In general, a niche content website will be sold for anywhere from 24 to 40 times monthly earnings. The most typical range is closer to 30 to 34 times monthly earnings.

In addition, you can buy websites in a wide range of values. A website only making $50/month would sell for $1,500 to $2,000, where a website making $1,000,000 a year would sell for closer to $3,000,000.

As a heads up, if you are looking to buy a smaller content site making $50 to $2,000 a month, you should check out MotionInvest.com. This is a marketplace to buy and sell smaller content sites that have been fully vetted by an experienced team. (In full disclosure, I'm a partner in Motion Invest).

Pros of Website Investing

A major benefit of investing in websites (when compared to real estate) is the high-income potential. As previously discussed, you can usually buy a site between 30 to 34x monthly earnings.

So, right out of the gate you can pick up a great income stream.

Quick Growth Potential

The potential to grow a site from making $1,000 a month to $2,000 a month in less than a year is not unrealistic. Nothing is guaranteed of course. But overall, you have the ability to quickly grow a website's earnings in a short period of time.

This is typically not the case with real estate. You might be able to raise rents a little or see some appreciation, but certainly nowhere close to double within a year.

Low Cost

The biggest benefit, that has already been mentioned, is that you can buy a site with a significant income for a relatively low cost. And if you are able to find off-market deals, you can sometimes get a site for an absolute steal.

Low Work Load

A big reason why many people are drawn to website investing is because of the passive nature of the investments. If you buy an established website that is already ranking in Google and is consistently getting traffic, you may not have to do much for it to maintain it's income.

Yes, you'll typically have to put in more effort if you want to grow the site. In addition, every site is different, and some may require significant amounts of time depending on the business model, or if you are doing all the work yourself.

Cons of website investing

Like real estate, website investing has some downsides that need to be considered. Despite the high-income potential, there are inherent risks that you'll need to take into account before making a decision to buy your first site.

Highly volatile

Investing in websites is risky. If investing in individual stocks on the New York Stock Exchange is considered risky, then buying websites would be considered extremely risky.

Sure, a website might double in value in a relatively short period of time, it can also go to $0 in just as short a time.

Again, because there are no hard assets, like real estate, if a website gets penalized by Google, it can lose almost all of its traffic overnight. I don't think I've ever seen a website go to literally zero, but I have seen websites lose half or more of their traffic in a period of a week.

Are you willing to take on that kind of risk?

Long term value is uncertain

Because of both the volatility and the ever-changing landscape of technology and search, it's extremely difficult to know how long a website will be valuable. A typical mortgage is 30 years, and you don't have to worry if your home will have value in 30 years.

However, websites in general, have not even existed for 30 years, and no one can predict what's going to happen with technology in 10 or 20 years. A website that people love and read today, might be long gone in 5 years (i.e. – remember My Space?)

While a real estate investment is almost guaranteed to appreciate in value over time, even if you don't do anything to it; a website has no guarantee that it will even exist in 10, 20, or 30 years.

Who should invest in Real Estate vs. Websites?

Now that I've laid out both the pros and cons of Real Estate and website investing, let's discuss what type of investor might select one option over the other.

If you are looking for the stability of your long term capital, then you should invest in real estate (and there are even great paying jobs in real estate investment trusts that may interest you). If you are more concerned with preserving your money than earning cash flow, then real estate is for you.

However, if you are willing to take a higher risk investment in order to earn a higher return, then website investing might be for you. If income is more important to you than knowing your capital will be around in 30 years, then website investing might be for you.

Both can be an avenue to wealth, but each has its own inherent risks that need to be considered.

If you'd like to take a look at the types of sites you can invest in to get started, take a look at what we offer at MotionInvest.com.

If you'd like to learn more about real estate investing, I'd recommend checking out the resources available at BiggerPockets.com.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations