Blogger Taxes: How To Do It The Right Way & Protect Your Business

When you buy something through one of the links on our site, we may earn an affiliate commission.

Paying your taxes is a necessary part of life, no matter how you choose to make money. Blogging can be quite a lucrative career that allows you flexibility, but how do you pay blogger taxes on the money you earn? It doesn’t have to be as complicated as you might have imagined and can be done in just a few simple steps.

In this guide to taxes for bloggers, we will cover who has to pay taxes, how to do it, what you can deduct, and how you can simplify your bookkeeping process.

If you are ready to tackle this challenge head-on, keep reading!

Contents

- Do You Have to Pay Taxes as a Blogger?

- Is Your Blog a Hobby, a Side Hustle, or Business?

- How to Pay Taxes on a Hobby

- How to Pay Taxes on a Side Hustle

- How to Pay Taxes on a Business

- How to Pay Estimated Quarterly Taxes

- Self-Employment Taxes

- Top 5 Deductions for Blogger Taxes

- Programs to Help File Taxes for Bloggers

- Blogger Taxes: Make It Easy

Do You Have to Pay Taxes as a Blogger?

For many bloggers, their online collection of work is seen as a hobby in the beginning. You might spend months or even years building up to the point where you make money from more lucrative affiliate marketing programs, display ads, and more. If this describes you, then you might wonder if you even have to pay taxes as a blogger.

Well whether you like it or not, blogger taxes are required if you make any income from your blog.

Paying taxes for bloggers doesn’t matter whether you are running the blog as an official business or just as a fun side hustle. Once you start to rake in that recurring revenue, it is time to start thinking about the taxes that are required so that you aren’t hit unexpectedly with a massive tax bill at the end of the fiscal year.

It counts as self-employed income and is subject to self-employment taxes. These can be filed in different ways, as we will cover in the following few sections of this article.

Is Your Blog a Hobby, a Side Hustle, or Business?

Now that you know blogger taxes are a necessity if you are making money (and I hope you are!), it is time to define what sort of blog you are running.

Is it a hobby, side hustle, or bona fide business? While all three will require you to pay taxes on any income you bring in, the way you pay taxes on each can vary slightly.

Hobby

A hobby blog exists for the sole purpose of sharing what you want to say with the world. If you are here, chances are you are making some money from your blogging efforts, but it is likely not your primary focus.

According to the IRS, a hobby is done for recreation rather than profit. And they even have a handy list of distinctions that separate hobbies from businesses.

Side Hustle

In a side hustle, you are focused on creating some type of existing revenue, but you may not have all the same systems in place that a real business would have.

Your blog will be a separate business entity where you can file taxes as a sole proprietor (we’ll cover more on how to do that in the next section).

Using high ticket affiliate marketing programs could be considered a side hustle even if you don't put much time into it.

Business

A business represents a significant source of income for you and often means that you will need to form a legal entity for your new blogging business. For example, you may form an LLC or an S-Corp that allows you to file taxes directly through the company instead of paying them quarterly (but make sure to also check out our guide on tax deductions for bloggers).

If you are receiving a primary source of income from your blog, then it might be time to consider establishing it as a real business.

How to Pay Taxes on a Hobby

Paying blogger taxes on a hobby requires minimal effort and can be pretty straightforward – as long as you keep up with your bookkeeping. Bloggers who aren’t making a ton of money might be able to get away with keeping up with income via a spreadsheet instead of paying for accounting software like QuickBooks.

Hobbies don't typically make much money, so you might be able to avoid paying estimated taxes like you would with a side hustle.

The IRS requires you to pay your taxes every quarter by set dates throughout the year:

- January 15

- April 15

- June 15

- September 15

While quarterly taxes are due on these dates, hobby bloggers can often avoid paying them due to their small income.

For example, you won’t need to pay them until the end of the year unless you owe more than $1,000 in taxes. While you will still need to account for the income at the end of the year when you file your taxes, you can avoid the hassle of filing quarterly when you have low income.

How to Pay Taxes on a Side Hustle

If you start a blog as a side hustle, your primary goal is to make money from your endeavor. You can pull off this impressive feat with luck and hard work. Be aware though, that it might mean more work for you when it comes to paying your taxes.

Traditional employees simply receive their paychecks and never consider filing taxes at HR Block until the end of the year. Bloggers must think about it four times each year. They have to pay estimated taxes on the income that they bring in.

Since nobody is subtracting taxes from income earned through your blog, you have to estimate what you will owe the IRS on a quarterly basis.

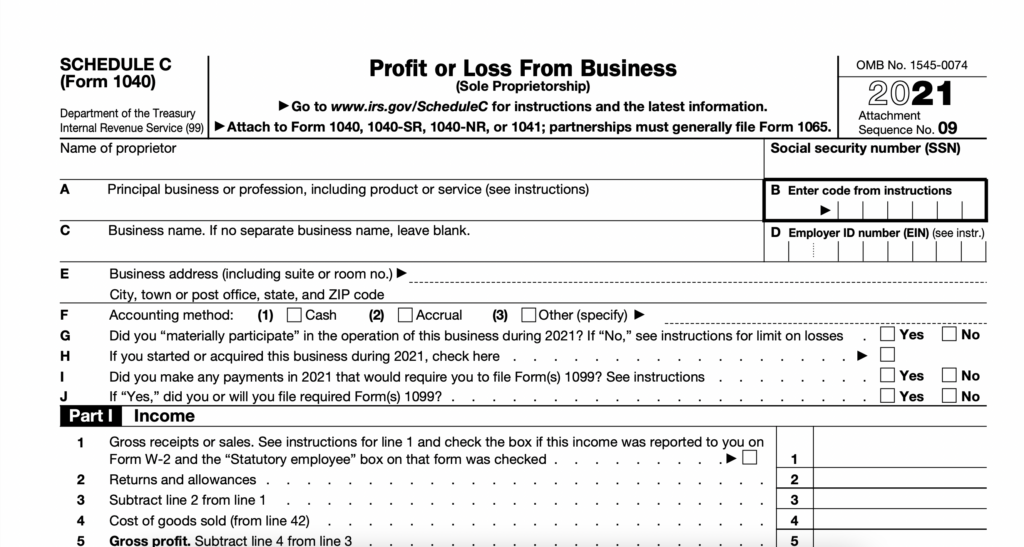

You can file your estimated taxes by filling out the 1040-ES form from the IRS. At the end of the year, you will file a Schedule C in addition to the 1040 tax form.

How to Pay Taxes on a Business

Businesses require something different altogether, depending on how you decide to run your business. If you are the only employee and choose not to create a separate business entity like an LLC or an S-Corp, you will file your taxes the same as anyone with a side hustle would. This is known as a sole proprietorship.

On the other hand, many serious bloggers decide to create a separate business entity because it has more legal protection for their personal assets.

If you do decide to run a more formal business, you can avoid paying quarterly taxes by running payroll.

While you will pay payroll taxes on the amount you choose to pay yourself or your employees, good software will help you to calculate how much you should withhold from your paycheck for taxes every month.

Don't miss our helpful guide on how to pay yourself as a business owner.

This keeps you from having to file quarterly taxes, but it does mean that you need to keep up with your books to ensure you can afford your salary, payroll taxes, and business taxes.

Getting a W-2

At the end of the year, you will receive a W-2 if you are on payroll. This is the same as if you worked for someone else in a more traditional job setting. You will need to pay income taxes at the end of the year while avoiding quarterly taxes.

Your payroll company will help you to keep track of what you owe and when. This can be a huge asset if you are nervous about filing SE tax correctly.

How to Pay Estimated Quarterly Taxes

If you are making enough money from your blog that you will need to pay quarterly taxes, you need to know how to do so efficiently. Filling out the 1040-ES form can seem complex at first. With a little practice, it is not that difficult to get what you need from it.

The hardest part of the entire sheet is figuring out what your expected income is and what profit will be subject to self-employment tax. Net profit can be determined using Schedule C of Form 1040 (line 31).

It is the difference between your profit and total expenses.

From here, you must follow the directions for multiplying your net profit to determine what you owe.

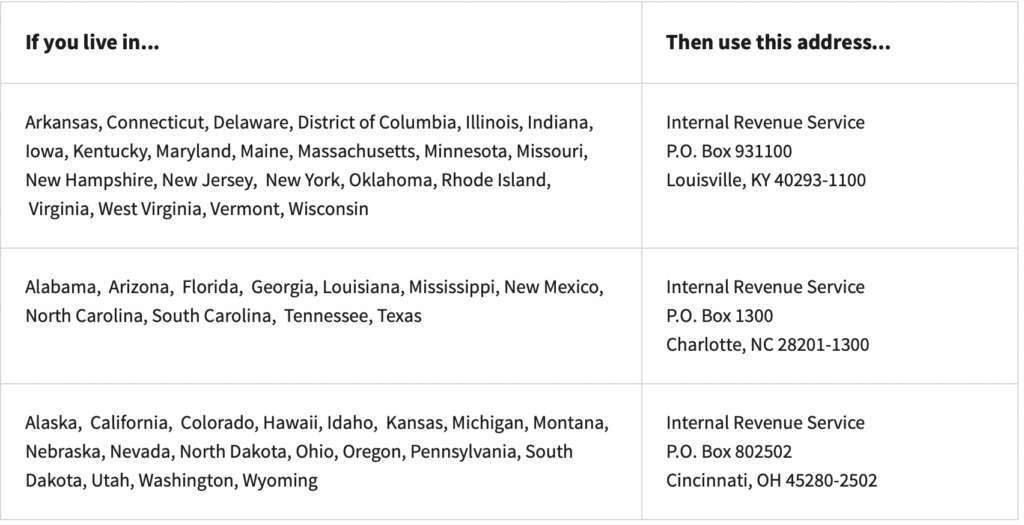

You can pay your quarterly taxes online here or by mail (see image below).

A Second Method

Alternatively, you might consider it from a different angle. You can estimate your taxes with the same worksheet if you know roughly how much you are projected to earn annually.

Tally up your income tax and self-employment tax for the year. Then, divide by four and pay each quarterly interval (January, April, June, and September).

Keeping up with your books is a necessity if you are going to be paying blogger taxes. To make this easier, I recommend QuickBooks Self-Employed which is a cloud-based solution that will keep track of your income and expenses and tally up what your quarterly taxes should be.

You can even pay them directly on the IRS website through the program.

Self-Employment Taxes

Calculating your self-employment tax is one of the more complicated aspects of filing your taxes for bloggers. This isn’t something you would have done with a traditional employer. However, it serves a very similar function to what would have been withheld from your pay as an employee.

“Self-employment tax consists of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners.”

-IRS

Your self-employment tax rate is 15.3 percent, broken down into two parts. The first 12.4 percent goes toward social security, while the remainder is for Medicare.

These self-employment taxes for bloggers are in addition to the income tax you must already pay on your revenue.

Top 5 Deductions for Blogger Taxes

While the taxes for bloggers can be quite high, there are some things you can do to offset what you owe the government. Deductions reduce your taxable income and allow you to invest back into the business, to some extent.

A Note For Hobby Bloggers

Blogger taxes related to a hobby are a bit different. You can only file for deductions that are equal to the amount of income brought in through your hobby.

For example, you might have had $100 in income but spent $500 on software for your computer. You can only claim a tax deduction of $100, even though you spent more than that on your hobby.

If you are running a business or a side hustle, you have more flexibility with what you can claim as a deduction on your taxes. Here are the top five deductions that most bloggers will want to try to qualify for.

Home office

If you decide to dive into blogging as a business, the odds are that you will work from home. Bloggers with a dedicated home office used exclusively for business purposes can claim this home office deduction (even if you rent your home instead of owning it).

The home office deduction on blogger taxes can give you a $5 per square foot deduction. This is good for up to 300 square feet.

Marketing

You might have some marketing costs when it comes to growing your business to the next level. Email marketing software, paid Facebook advertisements, and even PPC Google ads can count toward your marketing costs (learn more about Google ads costs here). Anything you spend promoting your blog can be written off as a tax deduction.

Learn More About Email Marketing

If you’re considering email marketing software, check out our review of FloDesk vs Convertkit here.

Equipment

While you don’t need much to get started as a blogger, a few pieces of equipment are absolutely essential. For example, you will need a computer and the accompanying hardware to work on your blog. This can include cameras.

You might even need software like word processing to help you get your thoughts out of your head and onto the page.

All of this equipment can be written off as a tax deduction at the end of the year.

Be sure to save your receipts so that you have them in case the IRS comes calling. This will help you verify what you spent on the necessary equipment to run your business.

Website and Hosting

While you may not need much to launch your career as a blogger, one of the most essential parts of the business is your website and hosting. This will be qualified as a business expense since you wouldn’t be able to make money as a blogger without it.

Keep tabs on how much you spend so that you can use it as a deduction.

Website Hosting

Learn more about free trial website hosting here.

Conferences or Memberships

Learning more about your craft is essential if you want to succeed as a business owner. If you attend a conference, you can write the cost of attendance and travel off as a tax deduction – as long as the event was pertinent to your work as a blogger.

Don’t forget to keep receipts for your tax return at the end of the year. This can include receipts that show reasonable costs for hotels, meals, and even mileage on your vehicle.

Programs to Help File Taxes for Bloggers

If you want everything to be organized to minimize your out-of-pocket cost when doing your taxes at HR Block, an accountant, or to save time doing them yourself, you need the right program. SE tax can be calculated quickly using these two programs.

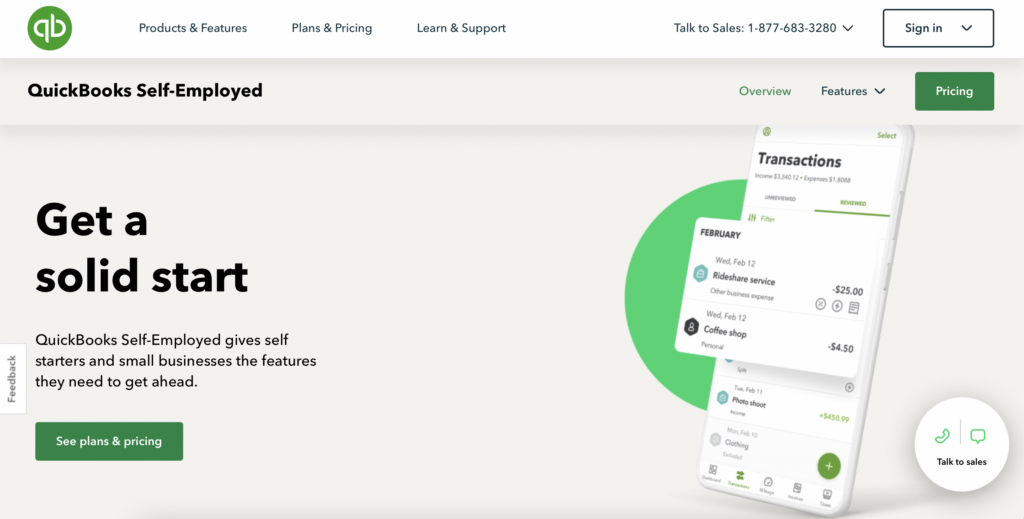

QuickBooks Self-Employed

Chances are that you have heard of QuickBooks before. They have a long list of products to suit just about any business need. And their self-employed version is excellent for bloggers. It gives you the capability to perform everything you need to keep your taxes straight, including:

- Sorting expenses

- Running reports to show profit and loss

- Organizing receipts

- Tracking mileage for travel purposes

- Uncovering tax deductions

One of the benefits of going with QuickBooks is that they estimate your taxes for you quarterly. They will keep tabs on what you owe to the IRS for your income tax and remind you when it is due.

You can even toggle straight to the IRS website, where you can pay your estimated taxes and log the payment in the QuickBooks accounting software.

QuickBooks also makes it relatively easy for you to file taxes for bloggers at the end of the year. Some of their subscription bundles allow you to file with Intuit TurboTax, offering significant discounts when tax time comes around.

Pricing

QuickBooks Self-Employed has three packages ranging from $15 to $35 per month. At the lower end, you get all of the basic features you might need, such as:

- Separating business and personal expenses

- Maximizing deductions

- Calculating quarterly taxes

- Tracking mileage

If you decide to go for the premium package (Self-Employed Live Tax Bundle) , you also get access to real CPAs, unlimited tax advice all year long, and a professional CPA review of your tax return at the end of the year.

All packages are 50 percent off for the first three months.

FreshBooks

FreshBooks is one of the biggest competitors to the QuickBooks Self-Employed software. Many bloggers find this helpful for their business because it covers every aspect of bookkeeping you might need. Blogger taxes will be easy to calculate when using FreshBooks because they help keep track of:

- Invoices

- Expenses

- Time tracking

- Projects

- Payments

- Basic accounting

It will make it easy to see where your money is coming in from and tally up your total income that is subject to SE tax. This can then be transferred to your accountant or you can complete the required paperwork independently.

Pricing

Like QuickBooks, FreshBooks has three-tiered pricing structures ranging from $15 to $50 per month.

At the low end, you can send invoices to up to five clients, track unlimited expenses, and get paid with credit cards or bank transfers.

Most people opt for the middle tier however which allows you to send invoices to up to 50 clients, plus you get all of the features of the Lite plan.

If your business is rapidly growing and needs to send invoices to unlimited clients, you should sign up for their Premium plan.

They also offer a 30-day free trial and 70 percent off for the first three months of your offer.

Blogger Taxes: Make It Easy

Taxes for bloggers aren’t as straightforward as having an employer automatically deduct them for you before you receive your paycheck. However, they don’t have to be overly complex or too convoluted to follow on your own. By knowing what forms you need and how to do it, you can start to tackle paying your taxes the right way.

If you are thinking about starting a blog, check out our detailed guide on how to start a blog here.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations