How to Pay Yourself as a Business Owner: Salary or Owner’s Draw?

When you buy something through one of the links on our site, we may earn an affiliate commission.

Most small business owners are eager for the day that they finally turn a profit in their company. They may have spent months or even years before the day that they finally see owner's equity in the business. The cash flow is good, but do you know how to pay yourself as a business owner?

Payment for your work depends on your business structures and preferences regarding your taxable income. It isn't as cut and dry as simply issuing yourself a paycheck.

If you want to learn more about how to pay self-employment taxes and how you should be paying yourself, here are the facts you need.

Contents

Salary or Owner's Draw? What Business Structures Mean for Payment

One of the most complicated aspects of learning how to pay yourself as a business owner rests in what type of business entity you have. Business structure is a key consideration for whether you will take an owner's draw or a salary.

Owners Draw

An owner's draw is simply when a small business owner decides to pay themself directly out of the profits of the business.

This type of payment doesn't require you to pay payroll taxes, but it will be taxed as personal income on your income taxes at the end of the year.

Salary

On the other hand, most people are familiar with the idea of a salary. You receive a set amount of money regularly from the business.

Business owners pay payroll taxes on this type of payment method.

Here is what you need to know for more information on how to pay yourself as a business owner.

Sole Proprietorship or Partnership

A sole proprietor and a partnership have one thing in common: these small business owners pay themselves via an owner's draw. Whenever you need an infusion of cash to cover your personal expenses, you can transfer money from your business account to your personal one -- no questions asked!

But make sure to keep detailed records of your owner's draws throughout the fiscal year.

While you don't pay payroll taxes on these draws upfront, you will have to pay self-employment tax at the end of the year. The IRS sees no distinction between your business profits and your personal profits, meaning that they will tax them as one and the same.

On your income taxes, you will need to pay taxes equivalent to 15.3% (12.4% for social security and 2.9% for Medicare taxes).

The best thing to do when you start taking owner's draws from a profitable business is to pay the IRS quarterly taxes. These estimated tax payments help you to set aside funds to pay taxes at the end of the year instead of waiting to pay everything in one lump sum.

You can pay them through programs like Quickbooks that integrate with the IRS online platform or send a more traditional paper check in the mail. They are due in April, June, September, and January, so keep tabs on these payments.

LLC

A limited liability company or LLC functions similarly to a sole proprietor or partnership. You don't have to put yourself on a payroll service and can take owner's draws whenever you want and can afford to do so.

If your LLC has multiple business owners, you can all take equal owner's draws if that's how you want to structure the business.

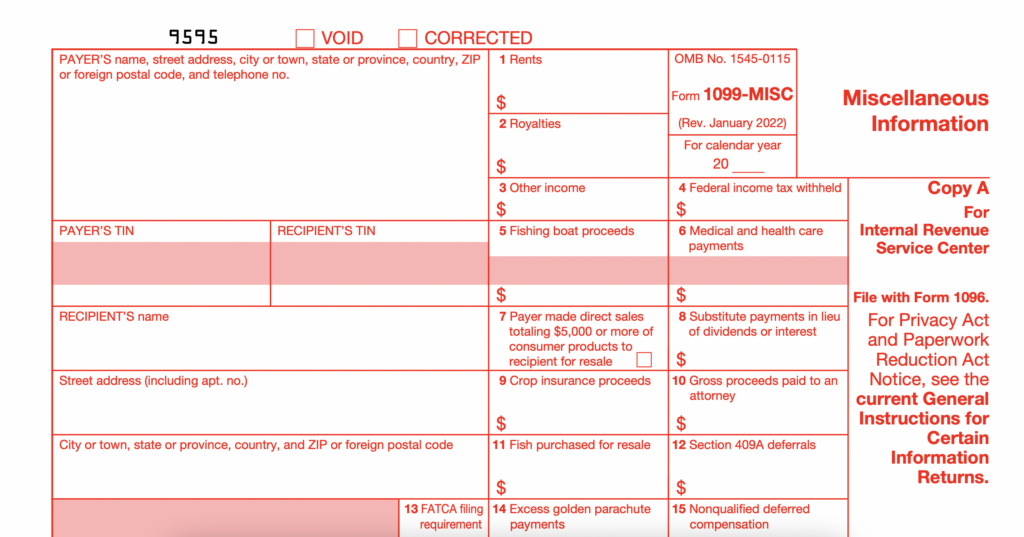

You can also choose to pay yourself as an independent contractor. This will give you a 1099-MISC at the end of the year to pay taxes on, and you will pay the same self-employment tax for social security and Medicare.

On the other hand, you may also want to pay yourself as a business owner through salary. You can add yourself to payroll if you have an active role in the company and responsibilities. This takes care of your need to file quarterly taxes and gives you a W-2 at the end of the year, making it easier to file your personal income taxes.

Corporation (S-Corp or C-Corp)

If you make enough money to warrant forming an S-corp or C-corp business, you have different options regarding how to pay yourself as a business owner. S-corps require that you get paid a reasonable salary and cannot take only owner's draws.

Many business owners who form an S-corp like the idea of paying themselves a salary. It makes it easier to budget for your personal expenses and makes it tidy to file your tax bill at the end of the year.

However, you can also pay yourself distributions based on the business's success.

Often, owners of an S-corp will pay themselves using a combination of salary and distributions. This allows them to set a reasonable salary for themselves while still benefiting if the business does particularly well.

A C-corporation business structure has similar options to S-corp business owners. You will be required to pay reasonable compensation if you work in the business. Still, you can also pay yourself dividend income if you and your shareholders agree to that as part of your compensation package.

What to Pay Yourself as a Business Owner

It isn't enough to simply know how to pay yourself as a business owner. You should also know how to set a reasonable compensation for your work.

No matter what type of business entity you have, here is what you need to know about paying yourself.

When Should You Pay Yourself?

The hard truth about starting a small business is that you might need to wait before issuing yourself a paycheck. Especially in the early days of starting a business, you likely want to reinvest profits back into the business instead of taking an owner's draw or setting up a salary.

If you're content with how much your business is bringing in and want to supplement your income or get some help with personal expenses, you can start taking money from the business as soon as it turns a profit.

A profit isn't just how much revenue you have coming in though. It's calculated from your income minus your expenses. If you don't have enough to cover your expenses, it isn't time for you to consider taking an owner's draw or a salary just yet.

Understanding Personal Expenses

Not everything can be written off as business expenses at the end of the fiscal year. Suppose you happen to be running your small business as your primary source of income. In that case, you also need to cover your personal expenses like your mortgage or rent, phone bill, electricity, and other essentials.

One way to ensure you have enough to cover these costs is to look at your cash flow with a detailed budget. You should know how much you need in your personal account each month.

Work backward to find out how much you need in your business account to make ends meet without losing the roof over your head.

Reasonable Salary Guidelines

If you operate an S-corp, you'll need to know how much to pay yourself as a salary. Some business owners try to get around payroll taxes by paying themselves a lower salary and taking higher distributions as the company earnings will allow for it. However, this can get you into big trouble with the IRS.

The IRS mandates that you pay yourself reasonable compensation, but what does this really mean?

Even if you are the only owner of this type of business, you have to account for what someone in your position would reasonably be paid for the work you do. Some of the guidelines to consider are set out by the IRS, and they include:

- Training and experience

- A detailed list of your roles and responsibilities

- Amount of time dedicated to the business

- Payment to other employees in the business

In addition, they will look at what other businesses like yours are paying their employees. If the average wage for a software engineer in your area is $75,000 per year, then they expect that you will pay yourself somewhere in the ballpark of this figure, if company profits allow.

To make it simpler, the IRS wants to ensure that you are paying yourself appropriately (with wages subject to payroll taxes) and not just taking an excessive owner's draw that isn't subject to the same federal income tax guidelines.

Taking an Owner's Draw

Whether you have a sole proprietorship or an LLC, the owner's draw is an important payment method you should be aware of. Never withdraw more money than your business can stand to lose.

You should know the total balance of all your business expenses, but you should also keep in mind some of the tips below.

Tips to Keep Your Bank Account in the Green

A small business that turns a profit needs to ensure that it still keeps enough money to stay afloat. There are lots of ways to earn money online typing, create money-making blogs, through content creation, and more. Even if you have a business in real life, what can you do to ensure that your business bank account stays in the green?

Keeping Personal Expenses Separate

As we mentioned earlier, keeping your personal expenses separate from business funds is important.

This means you should have at least two bank accounts for personal assets and business.

A savvy small business owner knows that this is the key to keeping records straight when it comes time to pay your self-employment taxes at the end of the year.

This also allows you to make room for budgeting and better managing your finances. It's important to know how to manage your money wisely in every aspect of your life, not just in your business.

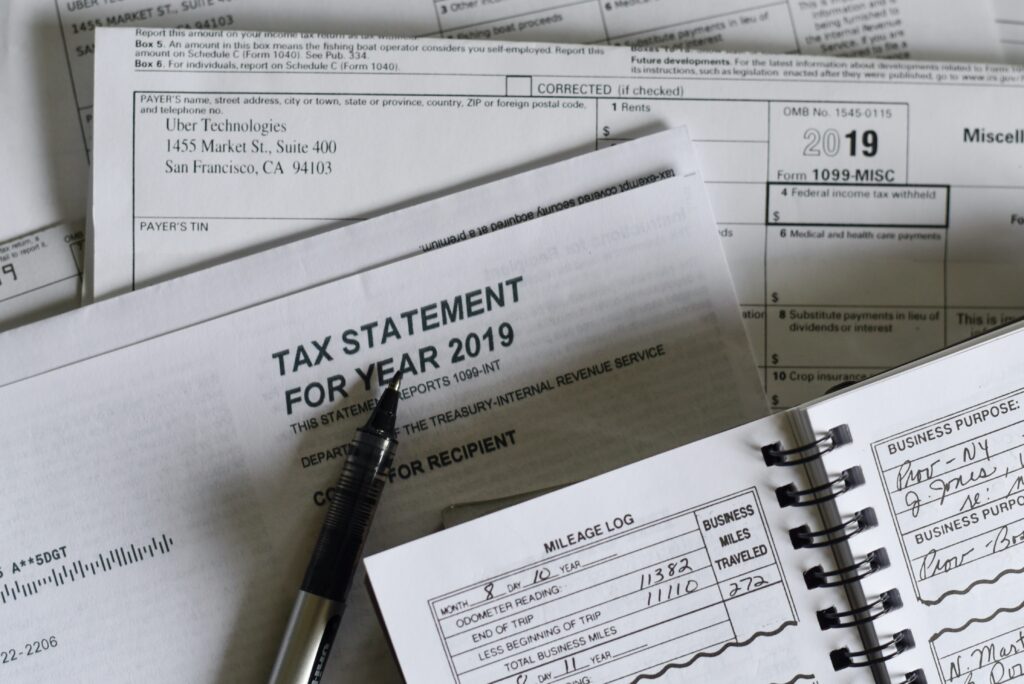

Account for Taxes

It's an inevitable part of working. You have to pay the government what they are owed to help cover the costs of running a country. For the most part, small business owners are required to pay self-employment tax as well as income tax on their personal tax return.

This is true if you run a sole proprietorship or a partnership.

If you run a business and pay yourself as a business owner on salary, then your payroll taxes will cover social security and Medicare expenses.

Either way, you need to make sure you account for the cost of those taxes before you start issuing yourself a paycheck. You might be surprised at how quickly costs can add up regarding your taxes. By ensuring you have enough money set aside to pay your personal income tax, you'll be one step ahead when keeping your bank account in the green.

And if you're a niche site owner, definitely check out our guide to blogger taxes!

Account for Inconsistent Performance

Your business won't see a steady incline in the right direction. Businesses of all kinds have inconsistent performance, especially in the early days. Just because you made a profit last month doesn't mean you'll have money left over this month.

Instead, it would help if you looked at the average left over at the end of the month for the past 12 months.

Figure out how much you need to cover your expenses, leave a little bit in your company reserves, and then see how much to pay yourself as a business owner. You'll likely find that your owner's equity isn't as much as you might have thought it was based on your highest-earning month.

Don't Forget Business Expenses

Social security and Medicare taxes aren't the only expense you need to account for in your business. It would be best if you accounted for every cost that it takes to keep your business up and running:

- Internet

- Separate phone line

- Overhead for rent, electric, water, etc.

- Website cost and maintenance

- Advertising

- Other employee salaries or wages

When calculating your salary budget, you need to look at how much money your business is bringing in. It would help if you also looked at how much money needs to go out.

Even if some of these expenses (such as buying a branded domain) are only paid annually, you still need to ensure that the money is there when the time comes to pay the bill.

Keep a spreadsheet with all of your expenses broken down by when you pay them and how much it tallies up to be each month. Remember: profit = income-expenses.

If you don't have much (or anything) left over after expenses, then it may not be the perfect time to start collecting a paycheck for your business.

Final Thoughts

No matter what type of business entity you have, you will eventually have to consider when and how much to pay yourself as a business owner. You'll need to look closely at the business profits to determine if you have enough equity in your business to make all of your bills plus a salary or owner's draw.

Are you ready to start paying yourself for your work inside of your business?

We sure hope you are whether it's a side hustle or a bonafide business. Keep these tips in mind to help you decide if the time is right for you to start pulling a paycheck.

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations