How Michael Bereslavsky of Domain Magnate is Leveraging Private Equity Deals Under $1 Million

When you buy something through one of the links on our site, we may earn an affiliate commission.

Michael Bereslavsky of Domain Magnate is bringing to online niche businesses.

Since 2004 Michael has been building . Over the years, he's had plenty of and unique experiences.

He found the best and profitability in , managing, and selling websites.

Today Michael is now the and of Domain Magnate, a micro specializing in and growing under $1m.

In addition, Michael is now a partner at Dealflow Brokerage.

Listen to the podcast to hear how Michael started, and a few of his most memorable deals.

Contents

Watch the Full Episode

Micro Private Equity

You can find a specializing in just about anything. , Oil, Public Works, Banking, Royalty funds, and even firms specialize in art investments.

has been around for a while now with their investment strategy into the micro online business world (online business less than $1 million).

brokerage like Q or Dealflow brokerage. Brokerages typically don't manage or take investors' money which is why Domain Magnate is structured as a .

The idea of a a company to restructure and grow for resale is not uncommon. It's probably the norm, but historically online niche websites would have been too small or risky and looked over.

What's unique is the investment opportunities. Michael and his team bring and to the for investors to participate in the .

Investment Opportunities

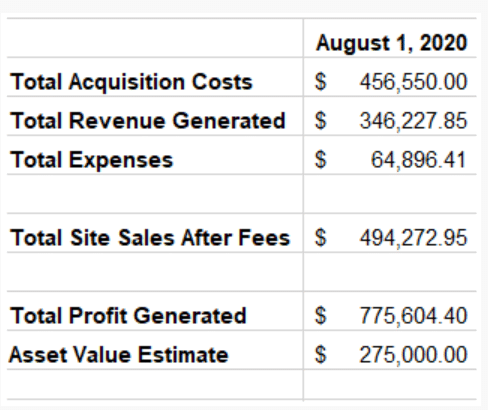

A typical operator would handle the ‘s day-to-day, where will put much more of the focus on the initial purchase and eventual sale of the for a profitable flip. (in addition to the day-to-day.) The minimum to invest in this space is currently $500,000-$1,000,000. The model is working well for the team. Their first fund generated a total profit of $775,604.40 and an asset value estimate of $275,000. You can see a few of their real success on their site here. They've sold 4 of the businesses for a combined amount of $494K, and have 5 remaining sites with a combined estimated fair market value of $275K. If the fund were to be liquidated now at a fair market value, the Total Value would be $1,050,604, with a Total Return of 130%. It would take some guts to manage someone else's portfolio of websites and take a lot of faith in the investors. So how did Michael get others to trust him with investing millions of dollars? Michael started working in in 2004. He was 19 going to University to be a software engineer. The problem was Michael was a terrible software engineer. In fact, he had trouble coding. He was getting interviews with some of the largest tech companies in the world, but once he reached the coding portion of the interview, he inevitably never got the job. It was around the same time, though, that Michael found he could make money with . His first entrance into the online business world was in 2004, and there were no courses that taught you how to make money online. Three short years later, in 2007, he made his first 6 figure income. He was pulling in $10-15k per month from Adsense. Michael recalls the hassle at the bank having to tell the tellers that he did not work for Google. “No I don't work for Google. It's a Google Ad Network payment”. Since then, Michael has completed hundreds of deals. Most of them relatively small sales but have consistently been growing in size. What started as $100 acquisitions went to $1000 acquisitions, and then $100,000. Michael even participated as an advisor capacity for 7 and 8 figure deals. Michael says the key to negotiating great deals is keeping a cool head and sticking to the facts. Deals will often fall through due to a small disagreement. By sticking to the facts, you are able to take a few of the extreme emotions out of the equation and land better and more consistent deals. To land a great during negotiations, knowing what you want in a is the first step. Whether it's for a or personally Michael chooses a set of criteria for sites to look at. For one of the key criteria is organic traffic. While there are lots of other factors it really comes down to the . For some, that could mean a content site, others a . Metrics such as price, earnings, or industry are just as important. Each Domain Magnate does is a bit unique, but there are a few similarities for each. Here are just a few of the steps Domain Magnate does when managing the process of , managing, and selling a site. When you are the first person someone thinks of when considering selling a website, you often get to be the first at the table negotiating and allows for a great for all parties. This experience allows their team to quickly identify the red flags and minimize the chances of a going bad. A fraud selling a site filled with PBNs or false metrics is unfortunately not uncommon and could mean the difference in success or losing thousands of dollars. By leveraging this network link building becomes much easier. At any time they can call on-site owners to build links. Even more, the Domain Magnate team isn't afraid to negotiate their own affiliate commissions. When managing multiple sites that small boost in income can add up and be worthwhile. Does the process work for all websites? Michael admits that it doesn't. One or two out of every ten sites will fail. We're all human, and making a profit 80% of the time is not bad at all. Some results are swifter than others. Sites are purchased with the intent of selling in six months to a year. Domain Magnate also considers holding onto larger sites cash flowing well. The team understands that the change is consistent and must adapt to the circumstance when necessary. Michael has seen consistent growth from $100 sites to $100,000 sites. So the natural next step is to go bigger. Michael says they look to buy a few low 7 figure businesses in the near term. Larger business deals and finding great people to work with are the current priorities at . Domain Magnate currently has twenty employees, and Michael did mention they were hiring more. If you want to get in touch with , learn more about their investment opportunities or available jobs, you can find more at DomainMagnate.com.

The first option is for accredited investors only. The fund will allow a larger number of investors to participate, and it will aim to acquire and grow multiple businesses and distribute profits to investors. You can learn more about this fund here.

When you invest in the fund, it's a passive investment, meaning you won't have much decision making in the process. will buy websites in the first year, grow those sites, and in the second year begin distributing dividends from either the revenues or sales of the companies purchased in year one.

In a way, this is similar to the operator model. As an , you own 100% of the company that is purchased. The difference between the operator model and the Buy Manage Program that the team offers is M&A processes.

The third way you can invest with is through a family fund structure. More considerable family funds or family office investors will come to Domain Magnate to diversify their portfolio by investing in the online businesses.

Current Portfolio Success

Getting Started

First Incomes

How to Negotiate Website deals

Selecting Criteria

Domain Magnate Process

Michael is a partner at Dealflow brokerage which was formally owned by Flippa. When it comes to sites Michael recommends to let your networks know you are interested in .

What's next for Domain Magnate?

Want to learn step-by-step how I built my Niche Site Empire up to a full-time income?

Yes! I Love to Learn

Learn How I Built My Niche Site Empire to a Full-time Income

- How to Pick the Right Keywords at the START, and avoid the losers

- How to Scale and Outsource 90% of the Work, Allowing Your Empire to GROW Without You

- How to Build a Site That Gets REAL TRAFFIC FROM GOOGLE (every. single. day.)

- Subscribe to the Niche Pursuits Newsletter delivered with value 3X per week

My top recommendations